Lodging Information

*Rooms based on availability; room blocks closes June 29th.

The Inn on Lake Superior (Main Hotel Block)

350 Canal Park Dr | Duluth MN 55802

Call to book | 218-726-1111 | Group Name "BankIn Minnesota" or group ID # 10865

Convention Rates: $249 - $279

Monday, July 29th – Friday, August 2nd (check-in/check-out dates)

SOLD OUT the night of July 30th

Weekend Rates: $259-$299

Friday, August 2nd – Sunday, August 4th (check-in/check-out dates)

Amenities:

•

Free parking (one space per room)

•

Outdoor rooftop heated pool with views of Canal Park, indoor pool, sauna, hot tub, 24-hour fitness center

•

Complimentary Continental Breakfast

•

Nightly S’mores 8pm-10pm

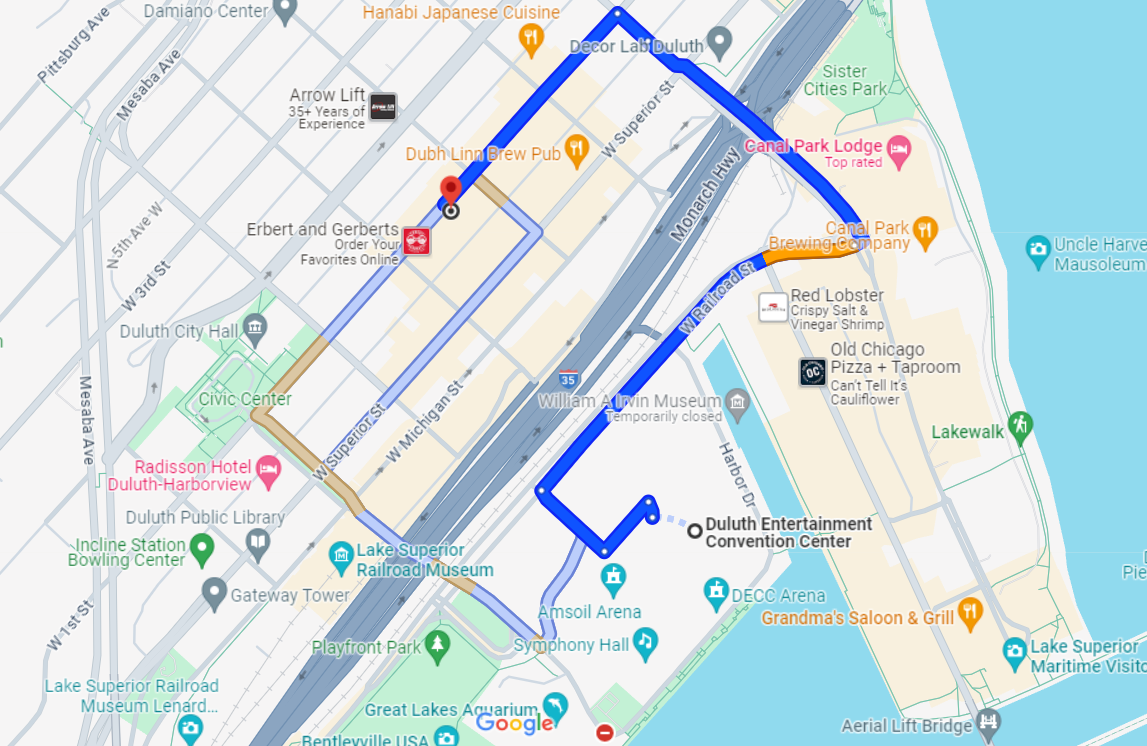

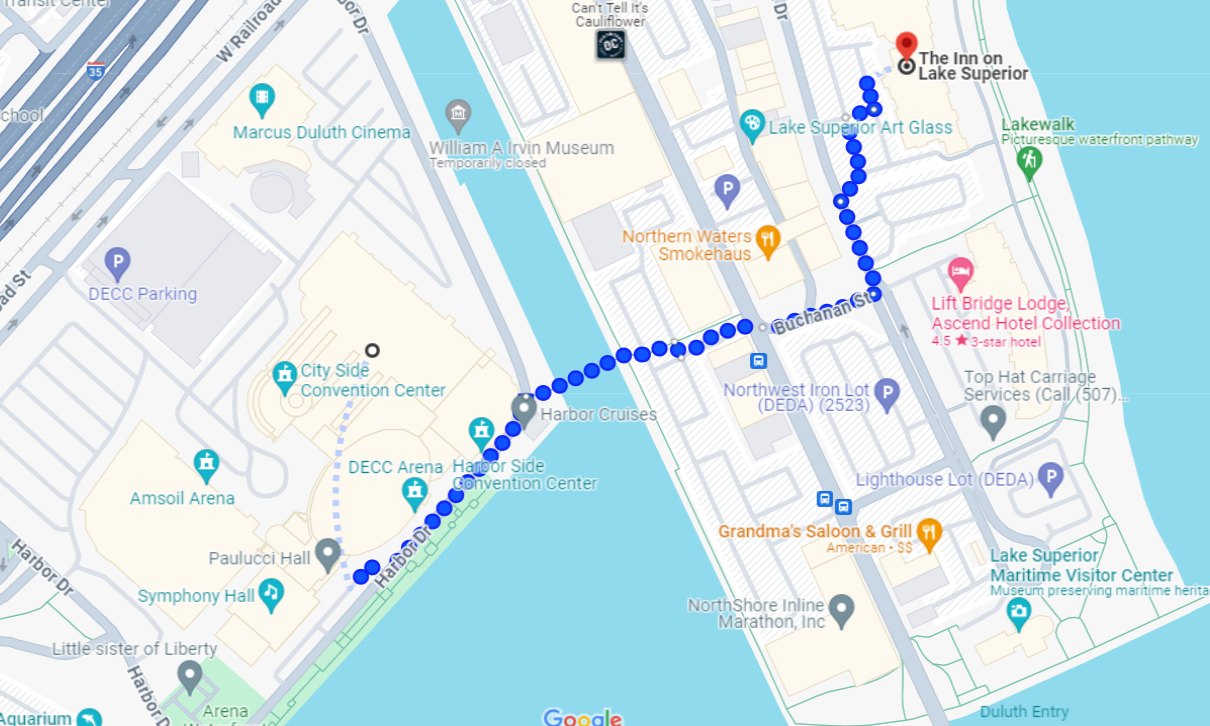

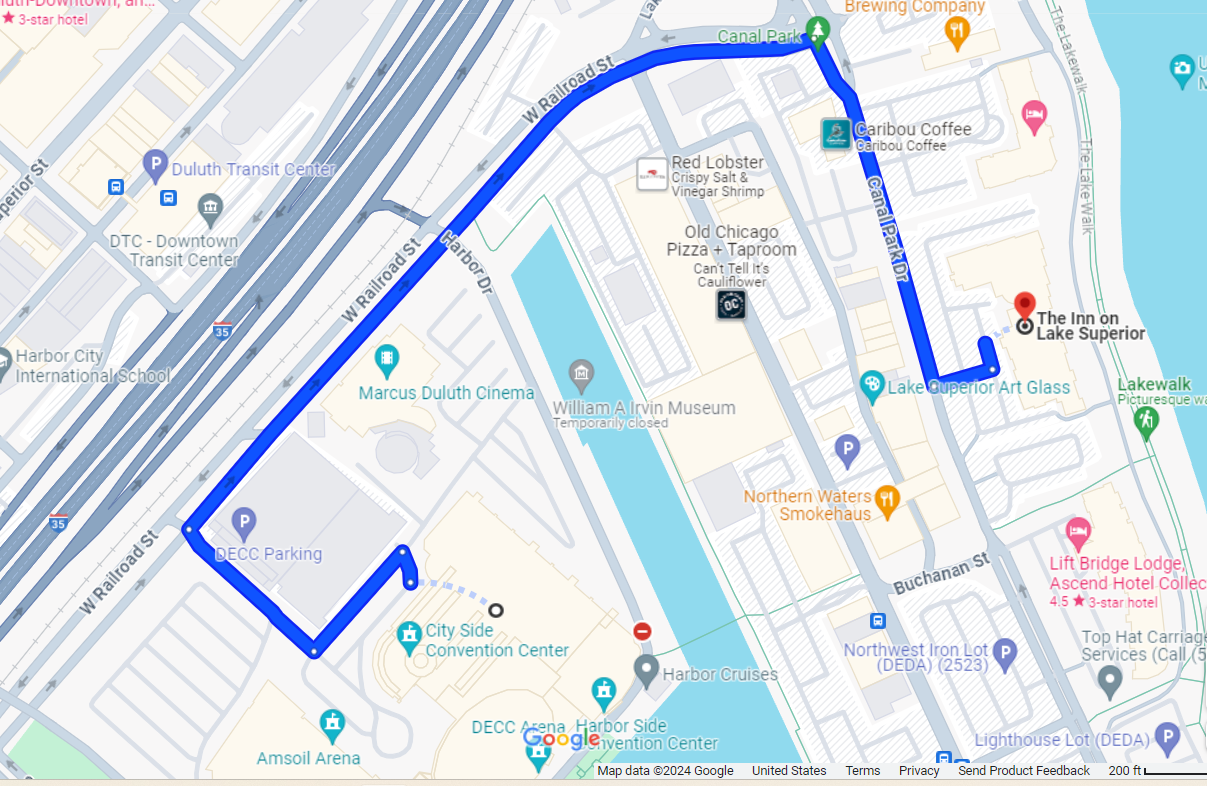

Walking Distance to Duluth Entertainment Convention Center (DECC): 8 minutes or 0.4 miles.

Driving Distance to Duluth Entertainment Convention Center (DECC): 3 minutes or 0.7 miles

Canal Park Lodge

250 Canal Park Dr | Duluth MN 55802

Call to book | 218-279-6000 | Group Name: BankIn Minnesota

Convention Rates: $249 - $289

Monday, July 29th – Friday, August 2nd (check-in/check-out dates)

Weekend Rates: $299-$329

Friday, August 2nd – Sunday, August 4th (check-in/check-out dates)

Amenities:

•

Complimentary Breakfast

•

Indoor pool and fitness center

•

Free parking

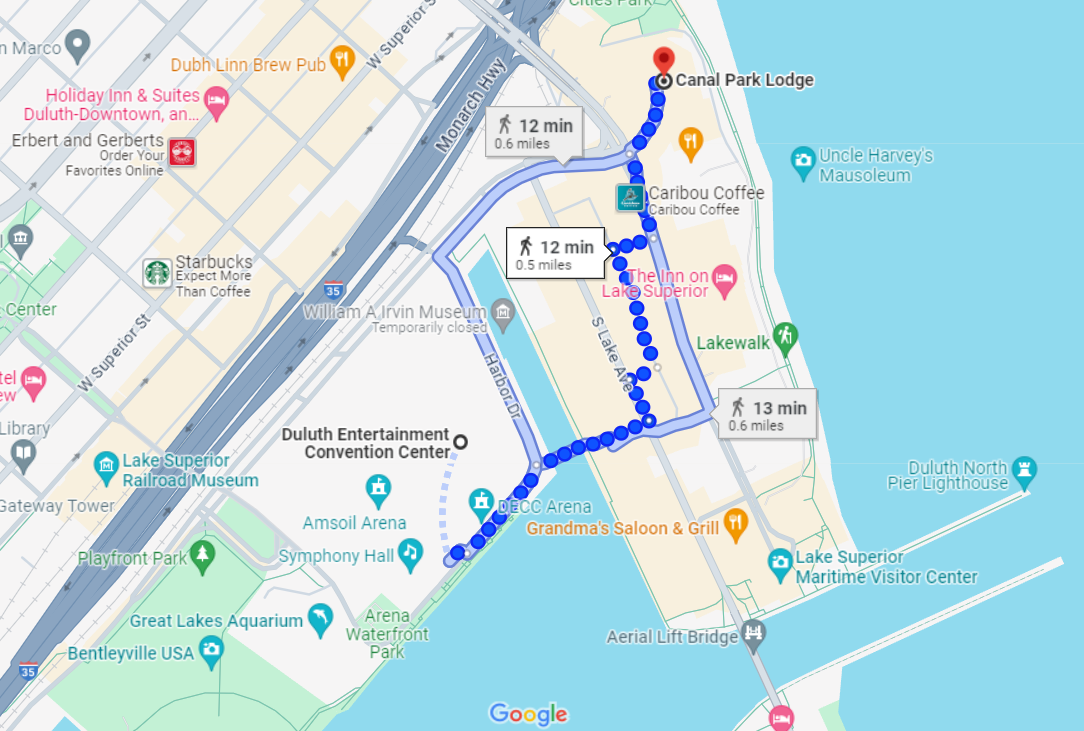

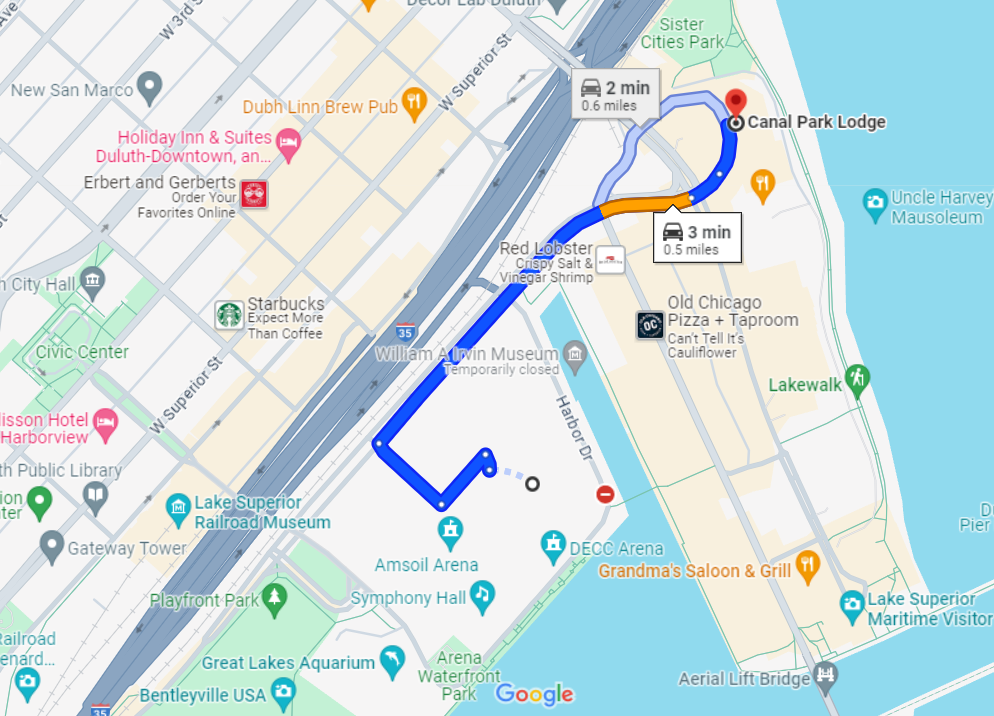

Walking Distance to Duluth Entertainment Convention Center (DECC): 12 minutes or 0.5 miles.

Driving Distance to Duluth Entertainment Convention Center (DECC): 2 minutes or 0.6 miles

Holiday Inn & Suites – Downtown

200 W 1st St | Duluth MN 55802

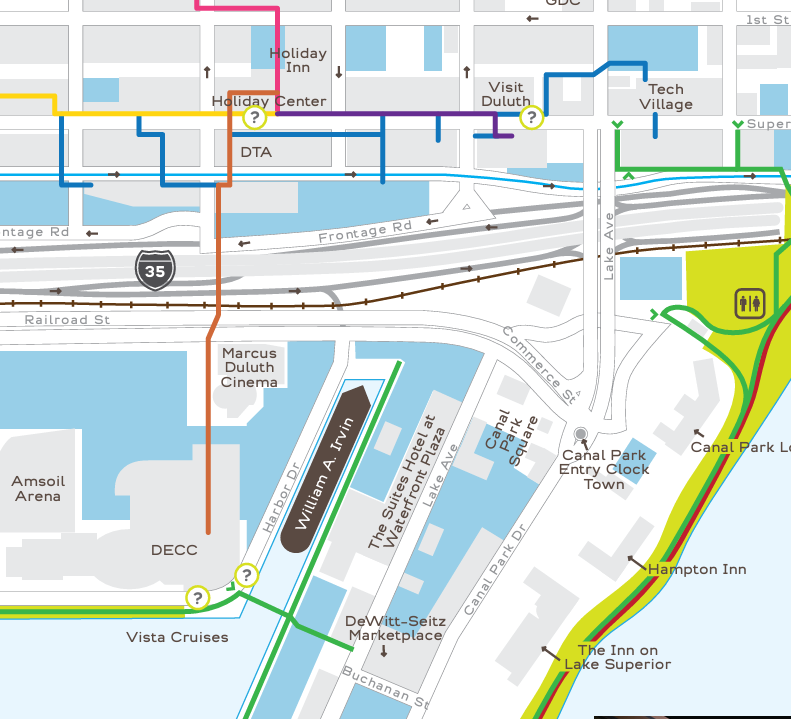

Downtown Skyway to Duluth Entertainment Convention Center (DECC)

Booking Link | Group Code: BNK

Convention Rates: $189

Monday, July 29th – Friday, August 2nd (check-in/check-out dates)

Weekend Rates: $249

Friday, August 2nd – Sunday, August 4th (check-in/check-out dates)

Amenities:

•

Nightly rates includes $15 voucher to The Greenery Cafe & Bakery for breakfast or refreshments.

•

Indoor pool and fitness center

•

Dining options for breakfast, lunch, and dinner

•

Free Accessible self-parking ramp

Walking Distance to Duluth Entertainment Convention Center (DECC): 5-minute walk via skywalk

Driving Distance to Duluth Entertainment Convention Center (DECC): 4 minutes or 1.0 mile